nhs* group is a

E-Invoices

The Growth Opportunities Act provides for the introduction of e-invoicing for domestic B2B transactions in Germany. This page contains all relevant information about this topic. Furthermore, we provide regular updates via our newsletter "E-invoices in Germany": Subscribe

Short Overview

All companies domiciled in Germany for VAT purposes will be obliged to issue e-invoices for their deliveries and other services if the invoice recipient is also domiciled in Germany. Exceptions only exist for tax-free services under § 4 No. 8 to 29 UStG as well as invoices for small amounts up to €250 (§ 33 UStDV) and tickets for public transport (§ 34 UStDV). The consent of the invoice recipient is then no longer necessary.

What may sound clear at first glance is sometimes not, however. For example, an intra-community delivery from Germany to the business premises of another domestic company in the community is also subject to the e-invoicing requirement.

An electronic invoice is not a PDF!

Within the European Union, the CEN format EN 16931 is intended for electronic invoices. This European standard defines a structured electronic format that enables electronic processing. In Germany, the invoice formats ZUGFeRD 2.1.1 and the so-called XRechnung currently fulfil this standard. Both invoice formats consist of a data record and, in the case of the ZUGFeRD invoice, this data record is supplemented by a PDF file.

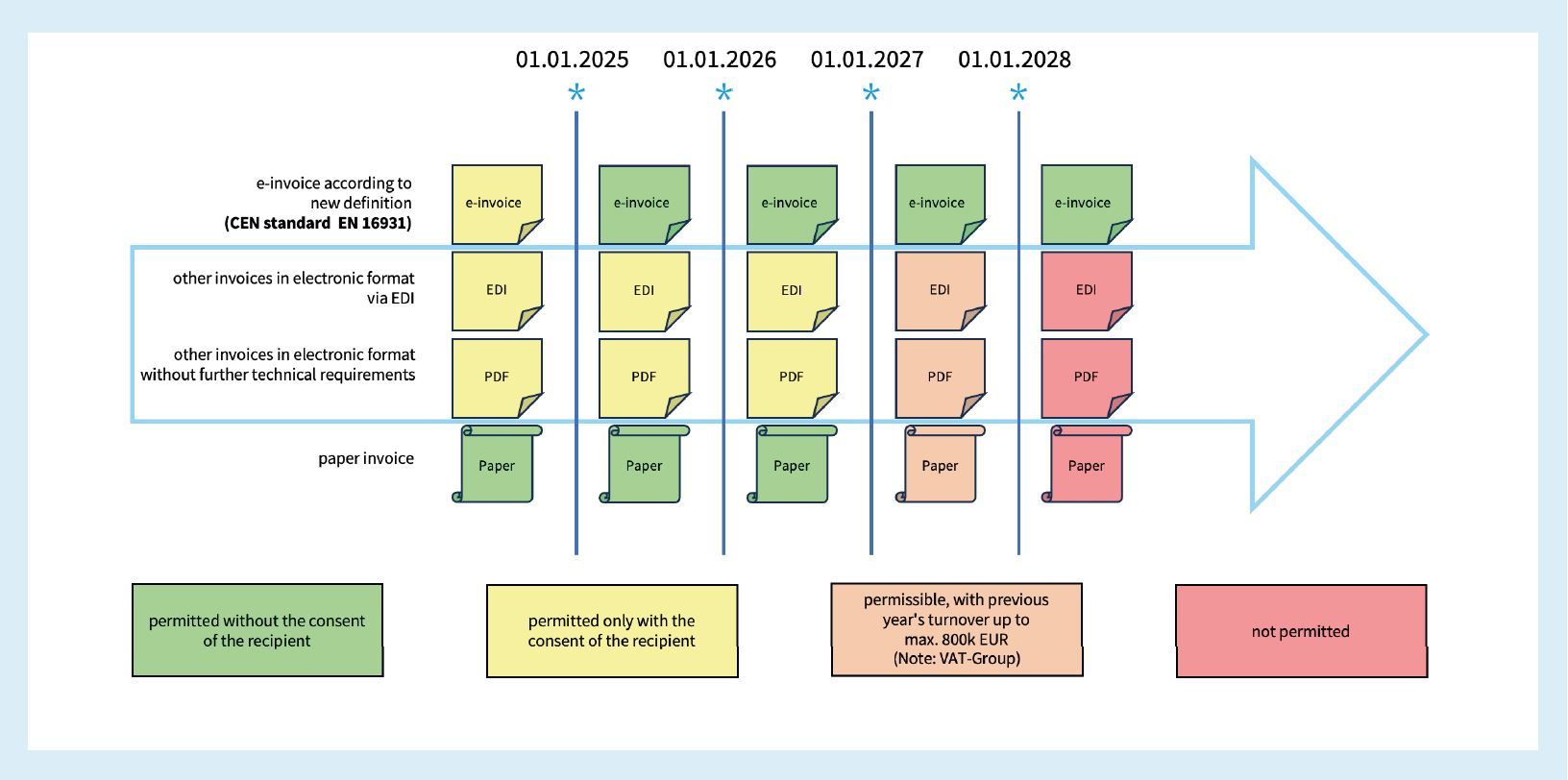

Implementation in phases

The introduction of the e-invoice will take place in phases between 1 January 2025 and 1 January 2028. The following overview shows the obligations for creating and, in particular, for receiving e-invoices, tiered by year:

Tools for E-Invoices

From 1 January 2025, all companies are obliged to accept e-invoices. Each company must create an e-mail inbox (e.g. invoice@company.de) to which the creator of the e-invoice can send their invoice. This means that companies must also be technically capable of processing these e-invoices in their accounting systems.

Candis Digital Invoice Management

Candis' digital invoice management includes the automatic import of invoices, a smooth approval process and seamless transfer to the accounting department. Whether ZUGFeRD invoices or XRechnungen – with Candis, the receipt, approval and audit-proof archiving of e-invoices are no problem. Data security is ensured by servers in Germany.

Services

- Automatic import of e-invoices + other invoices

- Approval processes incl. substitution rules with out-of-office notification

- Automatic suggestions for pre-assignment + payment terms

- Easy allocation of invoices to cost centers + G/L accounts

DATEV Belegfreigabe online comfort

With document release online comfort, invoices can be digitally checked and released. The digital process ensures a fast and transparent data flow - location-independent and multilingual (German, English). The DATEV software already meets all future legal requirements and enables the receipt, processing and sending of e-invoices.

Services

- Comprehensive digital invoice verification and approval

- Assignment of documents for approval to employees, teams or groups

- Automatic assignment through customized workflows

- Customized approval processes with dual control

More information about the DATEV solution (including tutorials)